Now is The Perfect Time to Get the Best Mortgage Rates

The year 2022 started with increasing levels of mortgage rates after at least 2 years of record-low rates. But you shouldn’t consider postponing our home purchase plans. However, the rates are significantly higher compared to last year. Some of the 3-decades old fixed rates are still near to where they were a couple of years ago.

There are many more that fall into home-buying decisions compared to only considering the interest rate. You make or select a lifestyle choice when you buy a home. However, the mortgage market interest rates can transform a decision. It is an efficient approach for not considering entirely a few specific points on a mortgage rate.

The most essential and effective thought is to set an actual home-buying budget and focus on it. Most of us are today experiencing plenty of nearly followed mortgage rates that have significantly dropped. There is a notable and continuous downfall in borrowing costs for 30-year mortgage fixed rates, while 15-year fixed rates also declined.

Driving Mortgage Rate Change

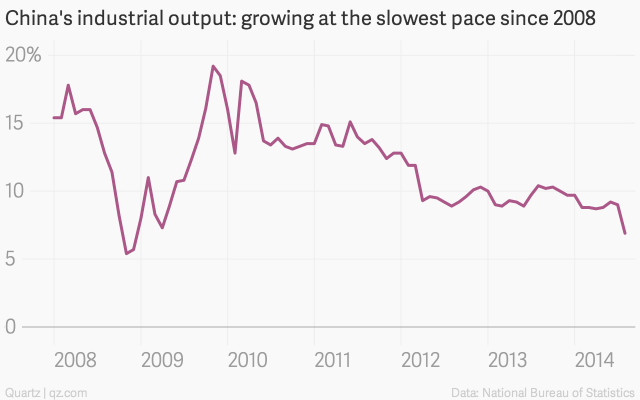

Most of us have experienced a sliding movement in the average rates of 5/1 ARM (Adjustable-Rate Mortgages). A variety of economic factors and other financial issues also increased mortgage rates in 2021. A senior economic expert at Lending Tree, Jacob Channel said constant high inflation is a major issue in home-buying or mortgage.

The inflation report of May 2022 shows the highest level of inflation in 4-decades at around 8.6%. The Federal Reserve has increased its standard short-term interest rate to fight against inflation. The Fed escalated rates by 50 basis points and 75 basis points in May and June respectively. However, the inflation stuck around higher than expected.

Mortgage Rates Increased After Fed’s Announcement

Moreover, the mortgage rates peaked in front of the Fed’s announcement following the inflation report. Jacob Channel said he thinks we are considering that lenders had already expected the Fed was seeking to increase rates. The Fed elevated the funds rate by 75 basis points and they started to proactively push mortgage rates higher.

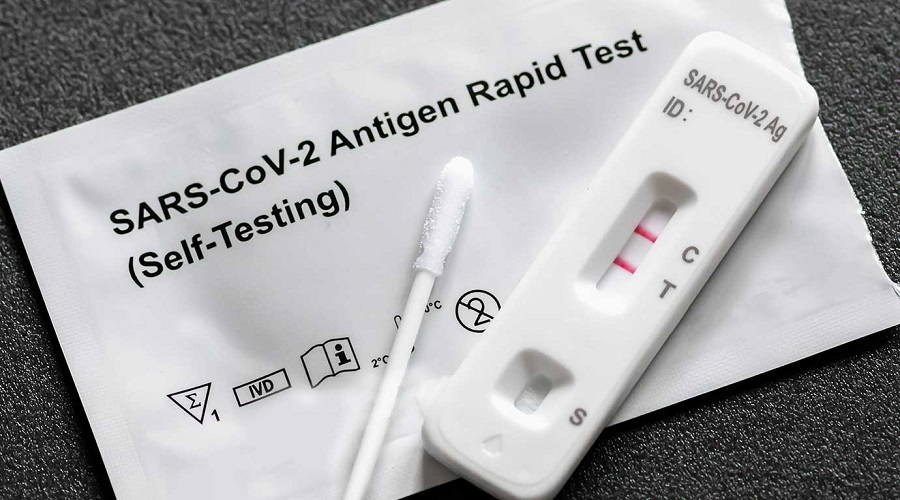

Meanwhile, experts believe the Covid-19 lockdown issue in China, the Russian invasion of Ukraine, and fluctuating financial markets were major factors. There are various other regional and global factors that are putting upward pressure on mortgage market rates. The founder of Insta Mortgage, Shashank Shekhar said the market is now practically adjusting to the latest news cycle every single day.

Current Mortgage Rates are Affordable

Mortgage rates are sustained at comparatively normal levels in spite of the dramatic improvements. However, there are significantly historic affordable mortgage rates. Home-buying prices are also at the peak and rates are continuously increasing and contributing to the increasing homeownership cost. Prices are considerably up from the beginning of the pandemic in combination with the limited supply of homes.

Meanwhile, higher costs to construct homes and increasing demand from buyers have also encouraged the surge. Mortgage rates are important but they would provide a lot of money over a 30-year time period. Experts have advised that it is a perfect time to get the best mortgage rate. You should focus on finding the right house and make decisions according to your lifestyle and financial situation.