New Social Security Contributions in Spain Officially Announced

Google search provides a significant amount of information regarding the new self-employed contributions in Spain. This article efficiently covers all the essential questions and explanations related to the new self-employed contribution system. However, this subject is a bit complex and features various loose ends.

Negotiation Process and New Contribution System’s Approval

The employers’ association and the representative groups of self-employed workers have finalized an agreement on the new self-employed contribution system. This deal took at least 13 months of continuous negotiations to reach an agreement between union groups and the government.

The Royal Decree-Law 13/2022 will regulate this new listing regime and will take effect on 1st January 2023. There were 3 listed fundamental reasons behind this quick and urgent process.

- The system was established in June 2022 to meet the commitment included in the Recovery, Transformation, and Resilience Plan.

- The implementation of critical technical and organizational modifications took enough time on the part of Social Security.

- Significantly time-consuming to explain to all the self-employed the attractive features of the new contribution system.

The Approval of Royal Decree-Law

The Council of Ministers approved the Royal Decree-Law and the Congress of Deputies earlier endorsed the law on August 25. So, the new regulated contribution system for the self-employed will become law at the beginning of 2023.

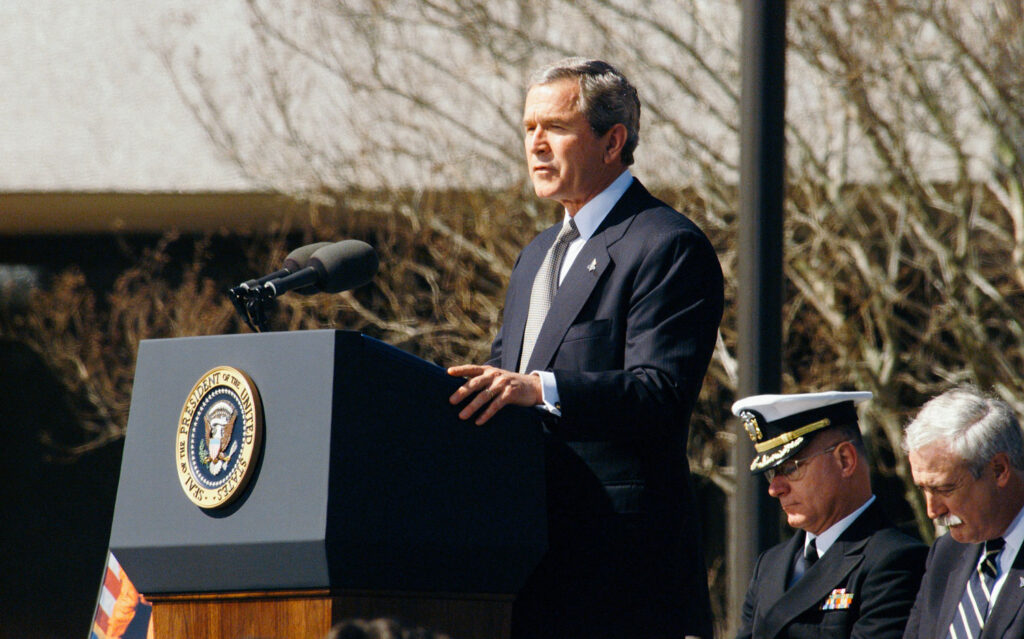

The Statement from the Government

It is important that Minister Escrivá on the reform of self-employed payments made specific statements. He said this reform will offer a way for the self-employed to harmonize contributions at any time in their working life.

Moreover, most of the self-employed are looking to contribute according to their net income, after the deduction of other expenses. The government has worked with social agents about these deductible expenses and to determine them with extreme accuracy.

The Statement of the ATA President Lorenzo Amor

Amor said he believes ATA has reached an agreement supposedly the best available solution. Around 75% of the self-employed will now pay the same or less than the current. However, 25% of the group contains 750,000 freelancers and will pay with a gradual increase of around 10% or 20%.

The increase is expected at half of the Government planned for the vast majority. Social protection offers coverage for situations of activity stoppage and even a decrease in income issues. This system has the capability to provide significant security and protection to the self-employed.

How People Could Act from 2023

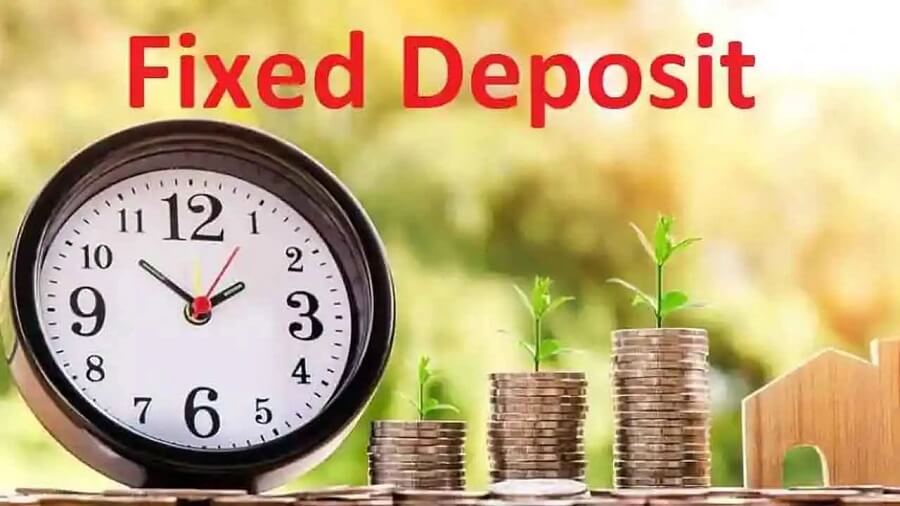

There are various concerns and questions about how much you will pay, how much contribution, and happening with a flat rate. However, the following 4 phases will hopefully simplify the possibilities.

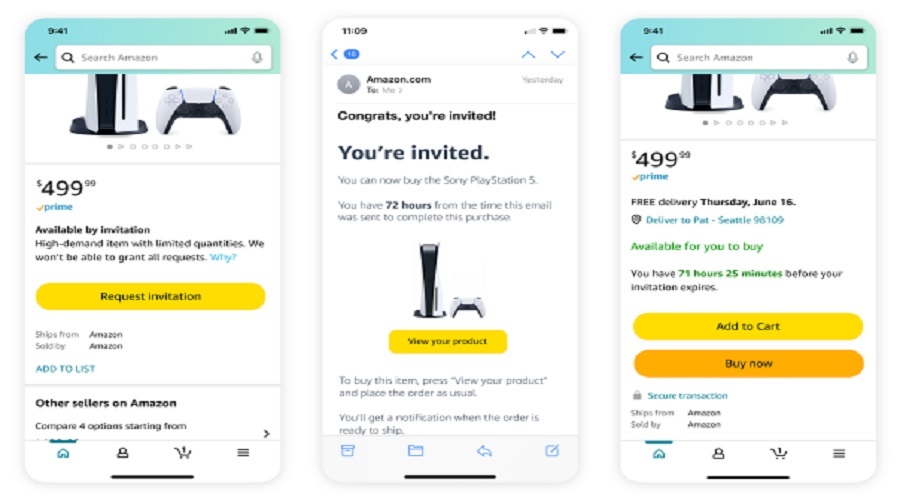

- You must ensure the estimation of your monthly net return as of January 2023. People will find an assistant and it will indicate a specific segment for their contribution. This is based on their net return’s monthly average.

- People must go to the table to explore the 15 sections and find one of them with that figure.

- Get knowledge about the section in which they are. They must select an amount as the basis between the minimum and maximum contribution.

- People will get their monthly contribution payment after applying 30.6% to that figure.

Supposed Modifications in the Flat Rate

One should have a better knowledge of the essential requirements to become eligible for the flat rate.

- You need to register for the first time as self-employed to become a member.

- One can get registered if he didn’t join the platform as self-employed in the last 2 years.

- You are not eligible if you previously enjoyed a bonus.

- A self-employed collaborator or a member of special administration for relatives of self-employed isn’t eligible.

You will pay €80/month fee in the first 12 months of the subscription in 2023 if you fulfill the above-mentioned requirements. However, you need to pay €60/month fee with the current flat rate. So, you can continue paying €80/month fee for the next 12 months. But it needs your annual net income less than the minimum annual salary (€14,000) in 2020.