Goldman Sachs Increased Interest Rates for Apple Cards

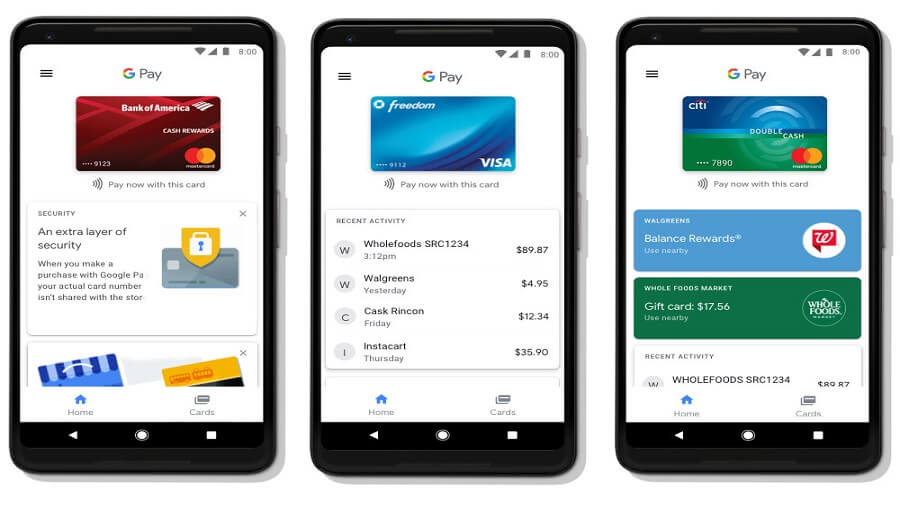

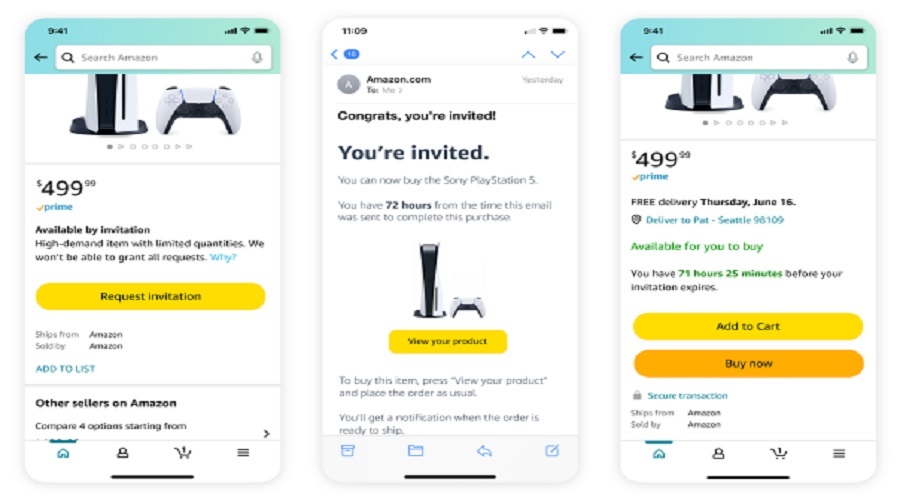

Apple Inc. created and Goldman Sachs issued Apple Card (a credit card). It was mainly designed to use with Apple Pay on Apple devices including iPhone, Mac, iPad, or Apple Watch. The card is currently available in the United States. There were at least 6.7 million American cardholders at the beginning of 2022. The company started sending invitations to selected users on August 6, 2019.

Apple Card was released in the US on August 20, 2019, while joint accounts and additional cardholders were not added on its initial launch. This card includes various consumer-friendly features such as no fees. It encouraged users to prevent debt or pay it down rapidly. The card offered the industry’s lowest interest rate compared to other available credit cards and was approved for more iPhone users.

Most of its features were found risky for a bank to encounter. It prompted other banks with settled consumer credit card operations including Barclays, Citigroup, and JPMorgan Chase to disapprove of Apple’s proposal. However, Goldman Sachs guarded the terms of the deal and said they were thrilled with the partnership. They were looking to disturb consumer finance by placing the customer first.

Apple Card offers Apple News+ and Apple TV+

Meanwhile, Apple Card was announced on March 25, 2019, at an Apple Special Event. This event was dedicated to new internet software and services, while former special events were conducted to announce upcoming hardware. The tech giant also announced other services at the event such as Apple News+, Apple Arcade, and Apple TV+.

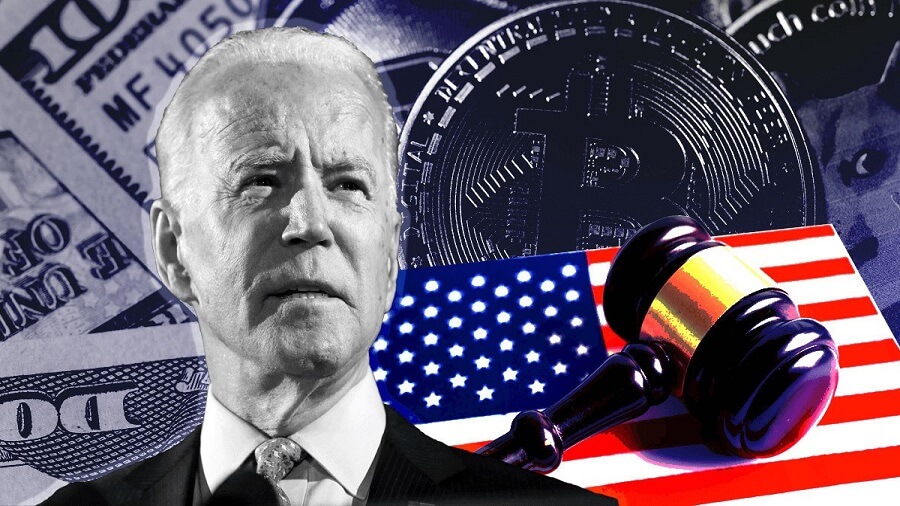

Apple Card is the company’s established credit card and it completely works with Apple devices in the Wallet app. The Card also provides Daily Cash with high returns at specific traders and offers more privacy to users. MacRumors pointed out that Apple is looking to significantly increase the interest rates for its credit card. This increase was in response to the increased interest rates from the US Federal Reserve.

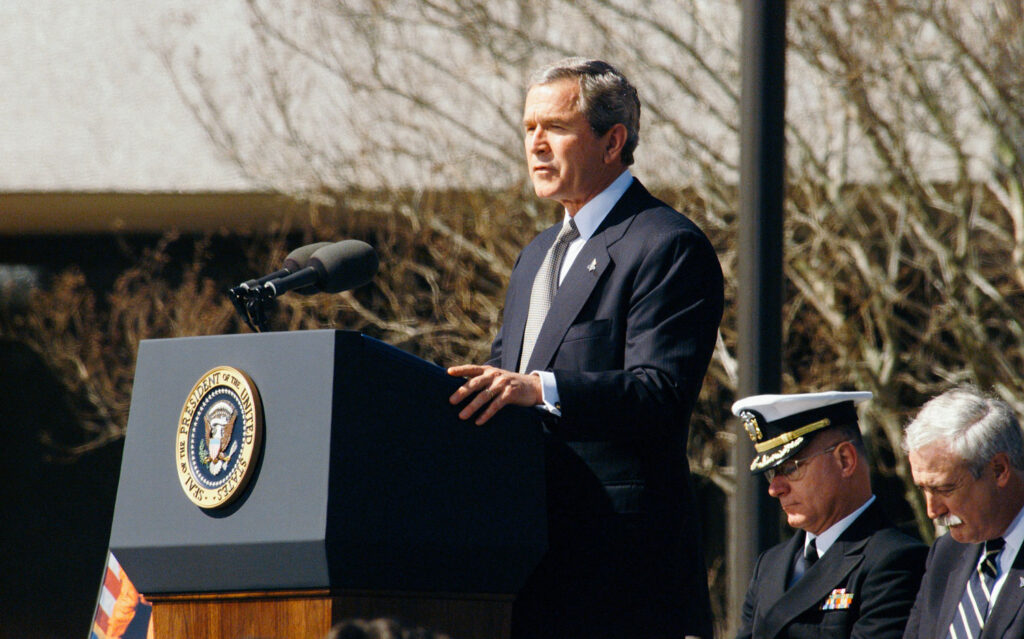

US Fed is Randomly Increasing Interest Rates

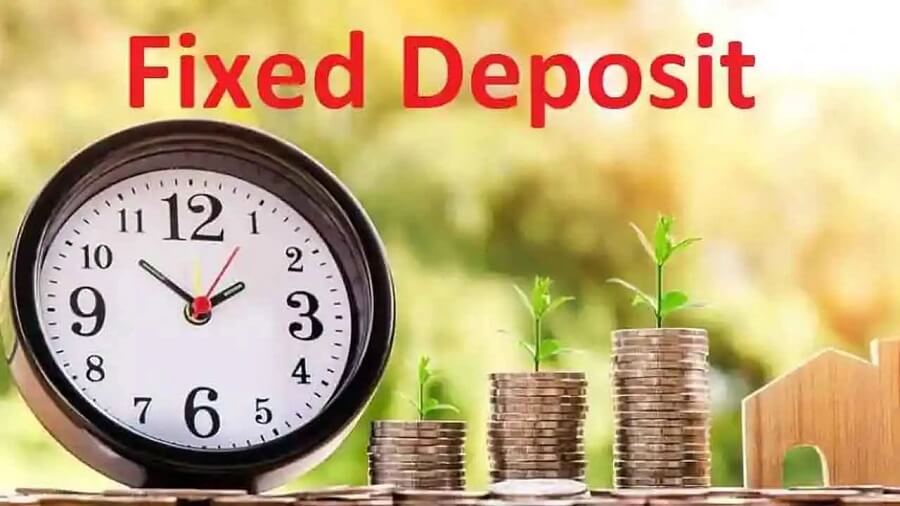

The US Federal Reserve is regularly increasing interest rates during the period of the last year due to growing inflation. This advancement will affect all Apple Card credit card holders from the 1st of July. It is still unclear whether it will continue to increase if the Fed continues to lift interest rates. Apple Card’s previously volatile rate APRs ranged from 11.74 to 22.74 percent.

Apple credit card’s floating APRs range changed on the 1st of July from 12.49 to 32.49 percent. Keep in mind that Apple Card’s APRs were just 10.99 to 21.99 when it was originally launched. Meanwhile, Apple isn’t appropriately increasing the interest rates on its own. Apple is offering its credit card through its partner Goldman Sachs, so Sachs is responding to the Fed’s increasing rates.

Every Payment Will Cut Down the Interest Amount

Moreover, it shows a more terrible situation for credit card holders in the coming days. The company will charge you more interest on the balance that you carry every month. It is noteworthy that the company will charge if you carry a balance on your Apple Card. The best approach to prevent paying more interest is not to pay interest at all.

It is perfect if you are paying off the balance every month of your card. Meanwhile, if this approach isn’t possible, then pay as much as you can. Every payment will help to cut down on the charging interest amount to your card. Apple Card offers privacy-oriented shopping, Daily Cash, and other rewards from a number of traders.