Bank of England will Purchase Bonds to Support the UK Government

On Wednesday, the Bank of England said it will launch a limited government bond-buying program. It is aimed to repel material risk to the UK’s financial constancy and durability. The move came after unfunded government tax cuts shocked markets by tumbling the British pound. The sudden interference indicates the central bank will supposedly buy government bonds.

The key objective is to support the market to calm down the increasing cost of government borrowing. The Bank issued a statement that it is monitoring the developments in financial markets very deeply. However, the recent measure took place in response to higher prices in the UK and global financial assets even long-dated UK government debt.

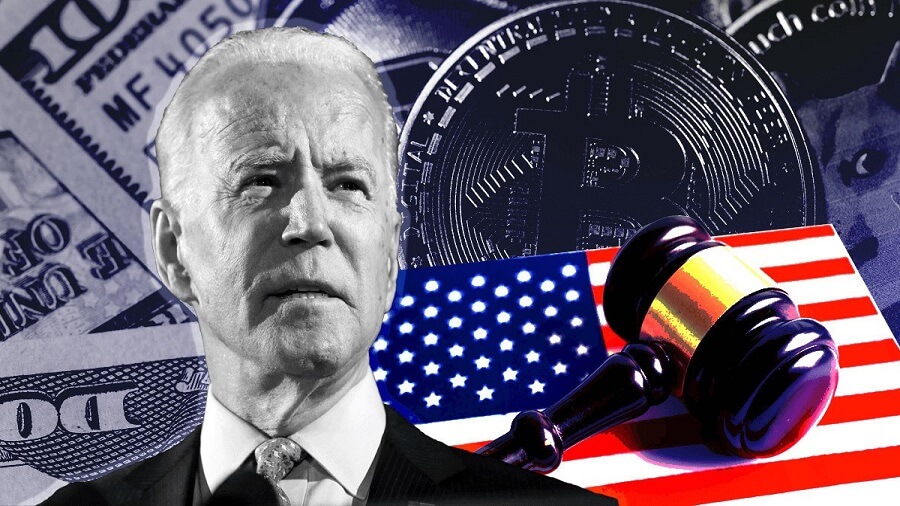

The IMF Warning Dropped the British Pound

The Bank will reportedly carry out limited purchases of long-dated UK government bonds from September 28. The key objective of these purchases is to efficiently restore fluctuating market conditions. It came after the IMF (International Monetary Fund) directed the British Conservative government to reconsider unfunded tax cuts.

The IMF also said unfunded tax cuts could fuel inflation with a significant increase in economic distinction. On Wednesday morning, the value of the British pound dropped after the IMF warning to Group of Seven economies. The UK government said it was sponsoring the emergency bond purchase for the central bank. However, the purchasing process is scheduled to end in 2 weeks.

The UK Government Seeks to Calm Markets

Meanwhile, the HM Treasury will entirely compensate for this operation to allow the Bank in managing this financial stability mediation. On Wednesday, Treasury Chief Kwasi Kwarteng met with executives from investment banks. The new government is looking to calm markets as its former decision threatened to impose taxes and increase borrowing.

On Friday, PM Liz Truss announced a £45 billion ($48 billion) package of tax cuts to spike economic growth. However, the plan doesn’t include spending cuts or independent cost estimation. It raised serious concerns that it could expand government debt to support handling inflation issues. Keep in mind that the UK is experiencing 40-years high inflation of 9.9%.

IMF Doesn’t Support Bigger Financial Packages

IMF issued a statement and said it will not recommend bigger and untargeted financial packages in this situation. However, the financial policy doesn’t effectively work at cross objectives to monetary policy. Experts have predicted that the nature of the UK measures will supposedly enhance disparity. The British pound dropped on Monday, to a record low against the US dollar to $1.0373.

The Bank of England is dedicated to supporting strengthening markets and was ready to increase interest rates to tackle inflation. But the next scheduled meeting of the Bank will not take place until November. Moreover, the British pound is still experiencing a 4% drop since Friday. Last year, the British currency dropped around 20% against the dollar.

Mortgage Lenders are Pulling Hundreds of Offers

However, the disturbance is already experiencing real-world effects. The mortgage lenders in the UK are pulling hundreds of offers from the market following expectations of increasing interest rates. The Bank of England has planned to boost interest rates to counterbalance the inflationary impact of the pound’s recent decline. The UK government has prevented inflation pressure from underneath course.

The Office for Budget Responsibility will release a more beneficial fiscal plan and independent analysis on November 23. Meanwhile, the November 23 budget will offer a remarkable opportunity for the British government to determine channels to provide support. The UK Treasury said the government was dedicated to boosting the economy to improve living standards.