Applying for a Personal Loan in Bangalore? Know the Process in Detail

If you are a resident of Bangalore and looking for loans to meet your fund requirements on an emergency basis, a personal loan can be helpful. This loan requires less processing time and fewer documents than other types of loans. It belongs to the category of unsecured loans, where you do not need to keep any mortgage or collateral with the lender. However, banks and finance companies may charge a high-interest rate on this type of loan as they have to face greater risk in case of default or non-repayment. Read on to know about the steps for applying for a personal loan in Bangalore.

There can be different ways through which you can apply for personal loans:

-

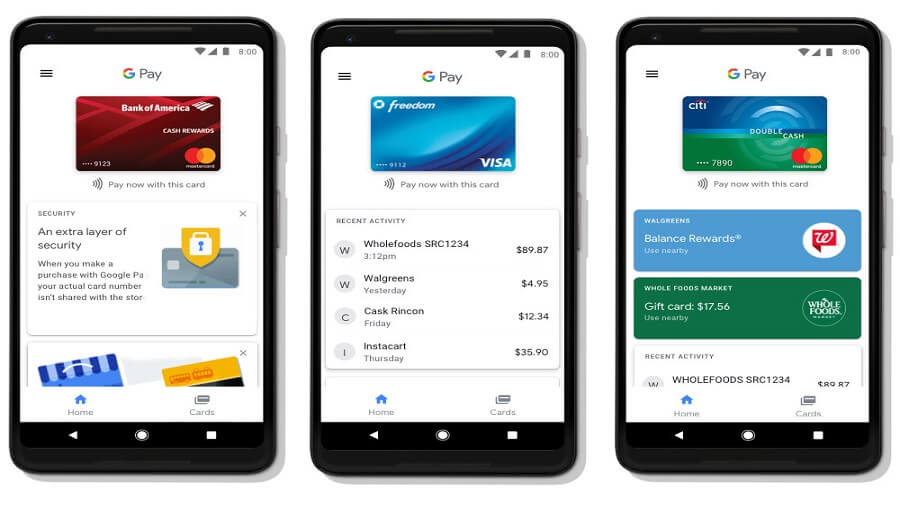

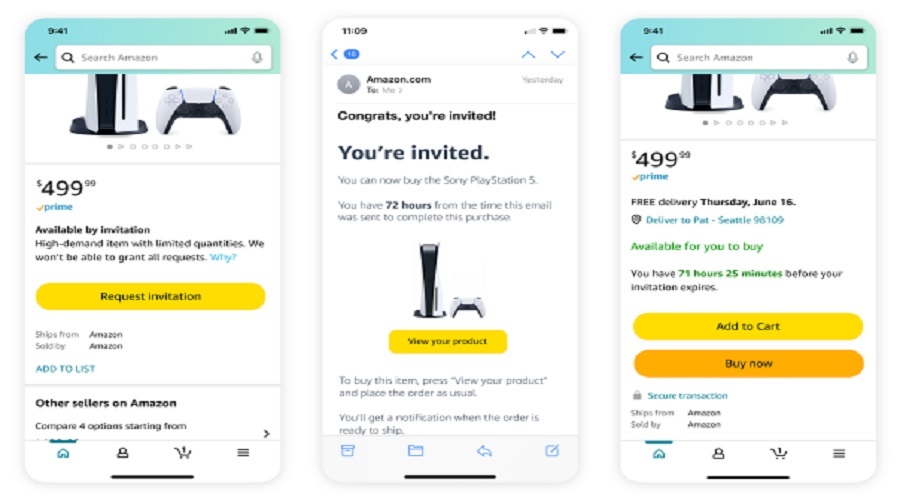

Online application

If you want to apply for loan from an existing bank account, you can raise the request online. You may be eligible for a pre-approval depending on your lender’s terms and conditions related to loans. In case you do not have an account with the lender, you have to visit the website of the lender and complete the application process. Enter the required details in the online form along with scanned copies of your income and KYC ( Know Your Customer) documents. Based on the details that you provide, the lender would approve your loan if you are eligible.

-

Offline loan Application

You have to visit the lender’s office or bank branch. Get a hardcopy of the personal loan application form and enter all the required details. Submit required documents as proof of your income, age, address and identity. The lender would verify the documents and transfer the loan amount to your bank account if you are eligible.

-

Email and phone banking application

Request for a personal loan from the lender through email or call up the customer service helpline number. Provide the required details. The bank would review your eligibility and contact you for further processes.

-

Loan application through ATM

You can also apply for personal loan in Bangalore at an ATM kiosk. You can leave your details for the bank people to contact you regarding the process.

The documents that you have to submit will vary between different lenders. Some standard documents that almost all lenders would ask for include:

- Age and identity proof like Passport, Aadhaar card, Voter ID card, etc.

- Address proof like house registration certificate, sales deed, Aadhaar card address, mobile bill or bank passbook address, etc.

- PAN Card

- Income proof consisting of Form 16, salary slips, bank statements, income tax certificate, etc.

- Passport-size photographs.

- Filled up and signed personal loan application form.

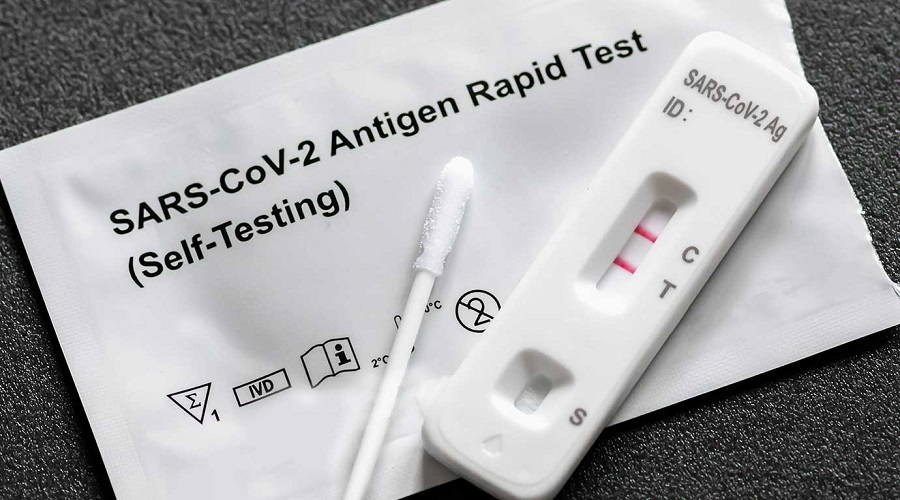

Post submission of the documents, the lender would cross-check the details. It involves:

- Checking of data provided by you with your bank balance, salary deposits in the bank account, EMIs (Equated Monthly Instalments) being deducted from your account, if any.

- Verification of identity, address and contact details with the KYC documents. In certain cases, the bank or lender’s employees may visit your residence and your workplace to find out the details.

- The lender would analyse your income tax return and salary slips to identify your repayment capacity. It would also determine the amount of loan that you would be eligible for.

- Some lenders would analyse your CIBIL score. Higher scores would increase your chances of getting the loan.

- The lenders also review your age, number of years of employment remaining, your salary growth prospects, etc. to decide on the amount of loan that they would approve and fix the repayment period.

- You can check the status of your application on the website of the lender. You can also call up the customer care or the branch office of the lender.

- To check the finance personal loan status, use the loan application reference number, your registered mobile number, and date of birth.

- Once the lender approves the loan, he will inform you through phone messages or email.

While applying for a personal loan in Bangalore, go through the websites of lenders or visit the bank branches and lender’s offices in your location to find out the details. Submit the required details and proofs through your preferred mode of loan application. Follow up on the status of your application after few days to understand the approximate time by which the lender would sanction your loan.