A Dental Insurance Best Guide in Texas

It is common knowledge that dental treatments can be costly. Even a simple cleaning can disturb your budget. Having complete dental insurance proves to be the difference between enjoying proper oral healthcare and living with cavities and gum problems. However, the work you can get done will be limited by the way your dental policy is designed.

Some are unable to avail of dental care since the treatment they require is not covered by their insurance, while some simply exhaust their maximum coverage and hence end up traveling in the same boat. Still, the general perception is that some coverage is better than no coverage at all.

So, how does one start? Below, after learning about the fundamentals of dental insurance and different dental policies, you’ll get to know about 4 key steps that you can take while choosing dental insurance that will help you avoid unexpected expenses:

Fundamentals of Dental Insurance

Dental insurance provides you with coverage to pay for certain kinds of dental work. These policies help the insured completely or partially pay for the work done by their dentists, from X-rays and regular cleanings to more serious treatments like implants.

While there is some similarity between dental and health insurance, the premiums that the latter entails are much lower. In the case of a majority of health insurance policies, once you pay your deductible, you get a good amount of coverage even if the expenses soar. There is a yearly out-of-pocket maximum too. Dental insurance is different for it involves a 100-80-50 coverage structure.

If you go for in-network dentists, you’ll probably get 100% coverage for preventive care like X-rays, cleanings, and examinations. For basic procedures like root canal, extraction, and filling, you’ll just be required to pay 1/5th of the total costs and half the cost is what you’ll have to bear for a gum disease treatment. Cosmetic dentistry and orthodontia, which are not considered necessary medical treatments, generally do not get any coverage at all.

There is no denying the fact that the elderly benefit more from dental insurance. Dental insurance for the old usually has the kinds of coverage that old people require and they are exempted from paying anything for root canal, tooth replacement, crowns, and more. Compared to people of other age groups, senior citizens are more likely to undergo these treatments. Those seniors who are on Medicare could require a different dental plan compared to those who aren’t.

Classification of Dental Policies

A) Indemnity Dental Plans

These are the costliest plans and they aren’t very common. They are also known as ‘fee-for-service plans’. Insurers put a cap on the amount they’ll pay for different procedures and if your dentist demands a bigger amount, you’ll need to pay it from your own pocket.

In the case of indemnity dental plans, you are often required to pay the entire amount and then file a claim. As your claim gets approved, your insurer will pay the portion they owe to you. The biggest advantage of having this kind of plan is that it does not have any network and you can choose any dentist that you want.

B) Preferred Provider Organization (PPO)

PPO is again the most common dental plan that you will find. Dentists are given to joining a PPO network and having negotiations with insurers regarding their fee structure. These plans could be costlier as a result of the administrative costs that they entail. Still, they are more flexible compared to other plans as they have a wider network.

C) Health Maintenance Organization (HMO)

As far as HMO is concerned, you’ll be restricted to a network and required to pay monthly or yearly premiums and reside in the area where HMO is provided. Of the three plans, it’s the cheapest and dentists may demand a fee for certain services.

4 Key Steps To Choose Dental Insurance

1) See if getting group coverage is possible

Many who have dental insurance are given benefits by their employer, group coverage programs like Affordable Care Act marketplace health insurance policies or AARP, or public programs like Medicaid, TriCare for the military, and CHIP (Children’s Health Insurance Program).

These plans are cheaper than individual insurance and could also offer better benefits. However, you must get into the nitty-gritty of a plan sponsored even by an employer to see whether paying the premiums will be worth it for somebody in your position.

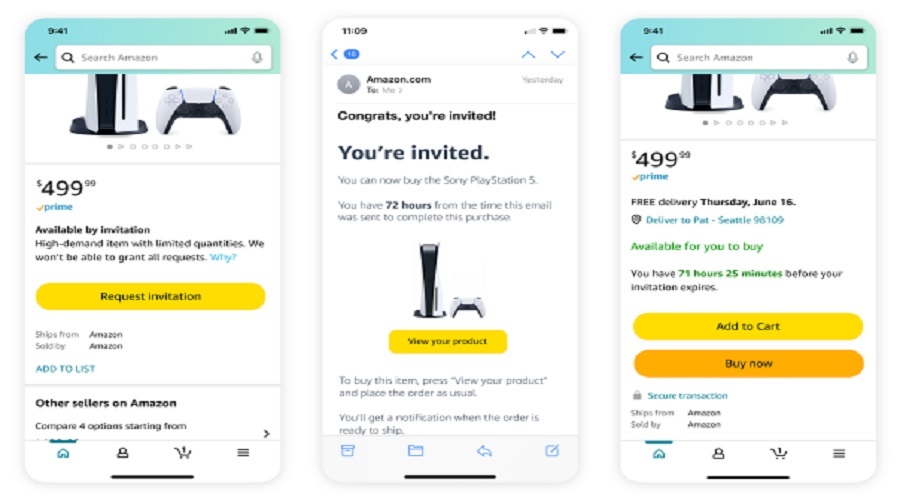

2) Or else consider individual policies

Individual policies are costlier than group ones, irrespective of whether you are purchasing a solo policy or one for your whole family. And the coverage offered by these policies has drawbacks too. They have greater limited benefits and an insured often has to wait until a major procedure is approved. If you decide to buy a plan at the eleventh hour just because you require new dentures or implants, it won’t work.

Insurers are familiar with such tactics and introduce a waiting period in their plans that lasts a few months or even a year before an insured can start availing the benefits that the plan offers. Some plans do not have waiting periods but they cost more.

Before taking a call, you can do a proper comparison. You can speak with an experienced insurance agent or procure policy details and quotes from the websites of insurance companies.

3) Inquire about the dentists in your network

If there is a dentist who you like, ask about the dental plan that they accept. As mentioned earlier, through indemnity insurance plans, you get your preferred dentist whereas the other two options limit your choices and confine you to the dentists available in their networks. If you are not looking for a new dentist, an HMO or a PPO could fulfill your need.

Still, you need to be cautious. A new dentist may recommend treatments that you may not have expected, possibly to make up for the low income earned through preventive services. So, seek recommendations from your near and dear ones to find a suitable dentist and try to learn about the insurance plans that they accept.

4) Find out what all a policy covers

By finding out what all your policy covers, you can create the right budget for dental expenditures – expected as well as emergency ones. For instance, in certain plans, you will have to wait till the second year to avail of certain benefits like crowns, implants, dentures, etc. and you may only be able to recover half the costs.

As you become knowledgeable of the facts pertaining to dental insurance, you’ll be in a better position to make a proper decision. If both you and your child require major dental treatments, you will have to bear a sizable portion of the overall cost. Even group plans have waiting periods and most plans recompense you partially for major treatments. Your friend or colleague may have the same insurer but their benefits package could be different. It will be advisable if you save some money separately in a personal fund or a health savings account so that there’s no cash crunch during a major treatment.

If you live in Texas, with all the information that we have shared above, you can try finding about the best dental plans in Texas and eventually select the best dental insurance plan in Texas for yourself.