10 Reasons to Hire a Financial Adviser

Financial advisory services are one service that is required not only by wealthy individuals but also by normal human beings. It is one service that can help in benefitting everyone in the long run. The suitable investment will help you increase your assets and protect yourself in case of any urgent requirement. The best part is that you can make the most from your investments and work towards making your future and your family’s future secure for a long time.

There are several reasons to keep in mind for hiring a financial advisor. They are as follows:

Protection of the family: There are several mutual fund products. The experienced advisor will guide you with suitable mutual funds worth buying and keeping in your portfolio for a longer duration. The advisor has the responsibility to look for your position and keep guiding you through one of the best options for protecting your family and yourself at the same time. They will look to offer a viable solution for everyone, be it a single person, a married couple, or a person reaching the retirement age.

To help with saving and spending: It is crucial for securing every person’s future, and for that, you will need to build a portfolio with long-term funds that will give you good returns. Therefore, the most crucial step is to work on your spending for saving, and another important step after that is to work on that saving so that you will be able to build wealth as smoothly as possible. Any amount does not matter; a financial advisor will understand your whole situation and work on finding a viable solution for yourself.

Planning your retirement: It is essential to focus on your short-term needs; once they are met, you can focus on long-term needs. Therefore, properly planning for your retirement is essential. It is a very complex business process, and there are many different various options available. The financial advisor will make it easier for the investor to go through the process by looking after all the rules and regulations. But will also work on making your portfolio vital for gaining on a long-term basis.

Security of house: Getting your own house to buy is one of the big decisions of your life. Taking the right Financial advisory services can help you save a good amount of money at a difficult time. They will not only work on getting you the best rates in the market; they will work on assessing the borrowing, make you get the best out of your deposit, and also work on finding suitable lenders who will otherwise not be available to you.

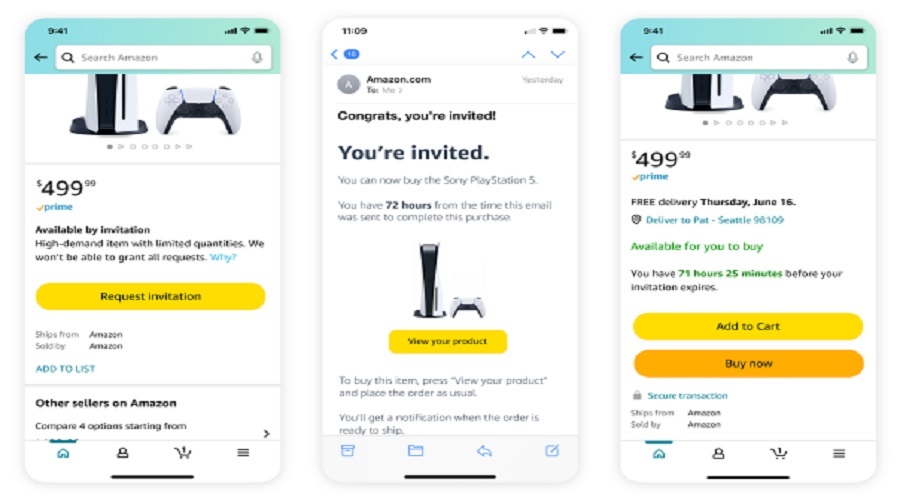

Achieving your investment goals: As you keep making progress in your life, the assets and income keep growing higher and higher. As a result, you will start improving your position rather than work on consolidating. Whatever the goal you will have in mind as an investor, a financial advisor will see what is possible and work towards a plan for helping you achieve the same. Many investors have a question: are mutual Funds safe for investing on a long-term basis?

The answer to these questions is that it is very safe for anyone to invest in mutual funds as the risk is divided in the portfolio itself. So there is no issue of facing any higher risk in your portfolio.

Right kind of assets: The main goal of investment is to protect against any potential fall and focus on achieving higher growth for the investor. Any big fund is associated with a higher risk, and no one would want their investment to fall in days to come. The financial advisor will work on making a good assessment of your behavior towards the risk before making any recommendations. The advisor will ensure that you do not work on putting all your eggs in a single basket but by helping in making your portfolio diversified with not only the mutual funds. But also with the individual accounts, individual funds, and the product.

Objective assessment: The financial advisor knows the effect of how products work in different market conditions; they will work on identifying the benefits and the downsides. You can work on making the best decision for investing by taking the Financial advisory services.

Work on saving: Once you have evaluated the risk and all the assessments are entirely related to the investment. The next thing is to look for taxes, and a basic overview of the position can help you in a long way. The best part is that the financial advisor will always keep in mind the tax position when giving the proper recommendations and guiding you in the right direction in any situation.

Follow the right track: Even when you have your investment on the right track, you are focusing on the plan. The best thing is to ask the financial advisor to keep a check on your investments. They will work on assessing the performance against their peers, focusing on seeing to it that the asset allocated by you does not become divided as the market keeps fluctuating regularly.

Focus on peace of mind: Money is an essential part of anyone’s life, and there are many things to keep in mind for protecting money. Unfortunately, markets keep moving up and down constantly; taking the help of a knowledgeable financial advisor can work on removing the barrier and make your move in the right direction.

Conclusion

Financial advisory services are one the best services that every investor wants to have for gaining a good market share on the investment made by the client in the long run. However, it is not an easy task to give you the right kind of result for your income to grow and be protected in case of any fall in the market. Therefore, it is best to follow the likes of a professional advisor who can work towards making your income grow ten-fold and make you more successful in investing.